Most organizations measure success in terms of revenue generated. If sales increase, for example, so too does the bottom line, and more often than not, that’s enough to make everyone happy.

But while revenue is critical to success, one of the main reasons organizations fail is poor cash flow management. Retaining control over every dollar spent is a tricky feat for many, but it’s equally as important as revenue growth in today’s uncertain world. After all, as the saying goes: to make money, an organization must spend money.

In this article, we break down one of the cornerstones of expenditure control: spend approval workflows. With personalized approval workflows in place, organizations can track every single dollar spent and begin cutting unnecessary costs which, much like revenue, contributes to a successful bottom line.

A purchase approval workflow is a formalized way to approve certain spend requests made by team members.

Organizations can use purchase approval workflows to set clear checks and balances for spend requests related to new equipment, new hires, new vendors, new budgets, and every other type of expense.

Well-designed approval workflows protect your organization from spending over budget and running out of cash. They’re a great way to streamline your entire spend management process, and they help team members save time.

Using a spend management system to implement personalized spend approval workflows also helps you gain clarity over over cent spent. Back and forth emailing to approve a purchase is inefficient and labor-intensive, but with the right tool, everyone can understand who is requesting money, who is assigned to approve it, and where in the process the request is.

There’s one key reason to implement spend controls (or approval routings) across an organization’s spend management process: to ensure all spending is accounted for. In short, pre-approved spending means that team members are purchasing from validated vendors and that they’re complying with internal controls and spend policies.

When managers approve spend requests before money is committed, an organization can safeguard its cash flow and reduce the risk of fraud or maverick spend, giving everyone visibility into spending against specific budgets.

Without an approval process for purchasing and expenses, organizations risk spending money they don’t have on hand and going into the red. As an organization grows, tracking every expense becomes almost impossible. Excel spreadsheets and email threads lead to ambiguity and confusion, not to mention a lack of compliance. And these factors contribute to mismanaged spend.

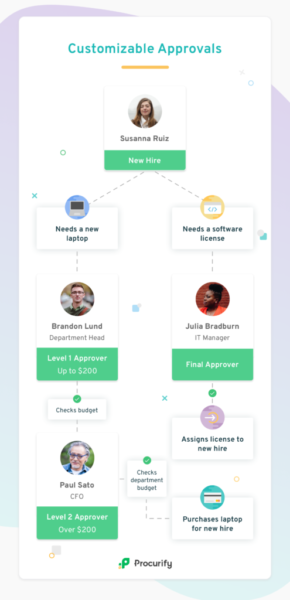

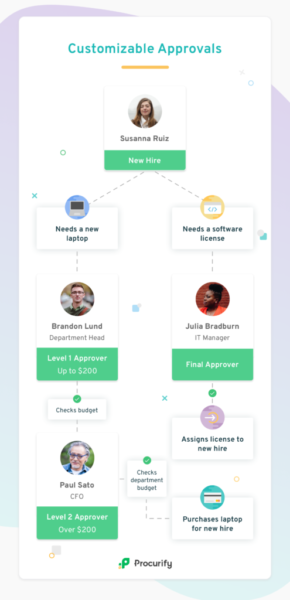

Here’s a visual example of how the approval process works when a new hire starts at an organization and requires a new laptop and software license:

Evidently, the need for a formalized spend and purchase approval process is quite clear. When designing an effective approval process to control spend, necessary components includes five steps:

The spend approval process starts with a request for spending (also known as a purchase order, requisition, request for purchase, or a request for order). This is a formalized step where every team member states their ‘intention to spend’. Simply, a team member needs to purchase something, and the request for spend is their way of offering transparency around what they need, and why.

A lot of organizations confuse a request for spend with the purchase order approval process, but they are not the same .

The same is true of purchase order approvals and invoice approvals . For many invoice approvals, teams have already spent money and the order is placed. For purchase order approval, money is still uncommitted and with the organization.

The approval chain (or approval routing) includes all the stakeholders required to approve a purchase before it happens. If you request a new software license for the marketing team, for example, the Marketing Manager will likely need to approve this request before a purchase is made. Depending on the size of the order, the Chief Financial Officer may also need to approve this request.

A well-documented approval chain does more than create transparency for those approving spend, though. For accounts payable teams, easily viewing a request’s history streamlines things like month-end reconciliations, reducing the amount of time required to investigate suspected fraud or unusual transactions.

Understanding and assigning the role of spend approvers varies based on many factors. Typically, many low-level purchases required for day-to-day operations only require one approver – the departmental manager. This singular check allows for managers to proactively manage spend against departmental budgets and either approve or deny requests based on how they’re tracking to their budget.

For larger spend requests, though, spend approval chains can require three or four stakeholders, many of whom oversee all organization spending. Permission levels should also account for when the approver is not available or is unresponsive (for example, on vacation).

This discussed approval process is only valuable if it removes bottlenecks for your team and gives them back time in their day.

To achieve this, though, any team member who is requesting spend should indicate the accurate due date required for each spend request. Crystal clear timelines help streamline the purchase process and also set the right expectations with all vendors.

You have two choices when it comes to audits: You can dread them, or you can remain prepared for them. Whether you’re relying on spreadsheets, emails, or a spend management platform, ensure that there is a way to access the secure audit trail and track the approval process for every single spend request.

To make sure that your team doesn’t wait for approvals, we recommend documenting every single part of your approval process in a formal spend policy template. This policy should become an essential part of your organization’s spend culture.

The burning question is: what’s the most effective way to build a streamlined spend approval process? The answer is automation.

Using an automated spend management solution, organizations can begin to customize approval workflows by dollar thresholds, users, departments, locations, and more, depending on specific requirements.

Your custom workflow will also depend on the scale of your organization, and your organization’s spend culture.

Here are six questions every organization should ask themselves when designing their approval processes:

Before you get to building your customized spend approval workflow, we want to identify why it’s important…

There are five key benefits to a personalized spend approval process:

Deploying a customized spend approval process is one of the most efficient ways to control spend. It also helps to curb fraud and improve cash flow position.

Designing an automated approval routing workflow helps everyone at your organization understand how to purchase the goods and services. A process like this also holds people accountable to what it is they’re purchasing, and why. At the end of the day, a clear spend approval process helps leaders retain control over spending. This way, they can make smarter operational decisions, which ultimately improves an organization’s bottom line.