Explore the controversial yet effective “Cash for Keys” strategy, a pragmatic solution for landlords navigating tenant evictions. Discover how this approach can streamline property reclamation while maintaining respect and fairness for all parties involved.

Do you know about cash for keys, and if so, do you find it a good way to get unwilling tenants to move so you can retake control of your property?

Cash for keys is controversial whether you’re talking about a landlord and a tenant or a bank foreclosing on a homeowner.

If you want to see how controversial this method is in practice, it’s easy to do. Join your local landlord association and tell your new friends that you’ve discovered a fantastic investment strategy for landlords: Cash for Keys , which works like a dream. Whenever you have an eviction looming with a tenant, offer them cash to move out instead of evicting them.

Here’s what will ensue.

In this post, we will discuss why cash for keys is controversial, and five tips and mistakes landlords make when paying their tenants to vacate the property.

The ‘Cash 4 Keys’ initiative, a less formal but widely recognized term for cash for keys, expedites reclaiming your property while offering financial assistance to the departing tenant. Learning more about cash for keys and how it works can help you determine when to add this method to your landlord toolbox. Follow along with today’s discussion below.

First question: what exactly is cash for keys?

Cash for keys is a way for a landlord (or bank in a foreclosure situation) to convince a tenant to vacate a property in exchange for an agreed-upon sum.

The Keys for Cash strategy, another name for the Cash for Keys program, offers a mutually beneficial solution to avoid the eviction process. This approach involves the tenant voluntarily handing over the keys to the property in exchange for a financial incentive.

Although it may seem counterintuitive, cash for keys is often less expensive than going through a lengthy eviction process. Typically, the amount paid comes with stipulations based on the condition in which the property is left.

Cash for keys is common when tenants can no longer afford the rent or are damaging the property. In other cases, it may be an option when a landlord purchases a new rental property and wants to move on from the existing tenants.

Yes, cash for keys is a legal and mutually agreeable method that allows landlords to reclaim their property by offering tenants a financial incentive to vacate. This approach avoids the lengthy and often costly eviction process, benefiting both parties when executed with clear communication and proper documentation.

As long as you are not forcing your tenant to take this option and both parties agree to the terms, you should be able to move forward with cash for keys. Of course, it is important always to pay attention to state and local laws. Laws are constantly changing, and there may be limitations placed on this type of situation in the future.

The biggest part of finding success when trying the cash-for-keys method is ensuring you do things right. You cannot attempt to persuade a tenant to accept this method with force or threats, nor should you sacrifice your financial well-being to do so.

This five-step process will help make the cash-for-keys method as successful as possible.

Approach the delinquent tenants and explain that they are violating the lease agreement and that you will start the eviction process. Outline the steps for eviction , the consequences, and the expense, and mention the potential impact on their future.

For example, many tenants who are late on rent may not realize that a formal eviction stays on the public record for up to seven years in most states. While some states, like Oregon, only show records for five years, finding housing in the future with an eviction on record can be difficult.

Tenants who want to avoid eviction on their record but do not have the money to pay rent may find it appealing to move forward with a cash-for-keys offer. This enables them to find a new rental without first fighting through the court system.

Once the tenant understands that you are offering an alternative to eviction, they may be willing to hear you out about what other options are available to them.

Explain that they can have cash in hand if they agree to be entirely out of the rental unit and turn keys over to you by a specific date with no damage to the property.

Share the date and the amount you have in mind with the tenants. Then, discuss.

Mastering how to negotiate cash for keys involves a delicate balance of offering a fair amount while ensuring your property is vacated promptly. Start the conversation with a reasonable offer and be prepared to adjust based on the tenant’s response and the property’s condition. The time spent coming to an agreement will likely be less than the time required to prepare for an eviction case , so you still benefit from the situation.

When doing this type of exchange, you must get things in writing. This is for the benefit of all parties involved.

To formalize the arrangement, draft a Cash for Keys Agreement (example provided below) that clearly outlines the terms, conditions, agreed-upon amount, date, and time. This contract ensures that both parties are legally protected and understand their obligations. The agreement should state that the eviction will proceed if the tenants are not out on time.

Put as much detail into the document as possible, clarifying what will happen to the security deposit, how much money will be exchanged, if the tenant will still be responsible for any owed rent, and more. The more detail, the better for everyone involved. Have all parties sign and date the document once you agree.

On move-out day, be at the property with the paperwork and the check. Once the tenant is completely out of the property, you will want to do a walkthrough to ensure the property is left according to the terms of your agreement.

After you do the walkthrough, sign the final papers and exchange the keys for the money. That’s it, it’s over.

Now that the tenant has completely moved out, it’s time to go ahead and take care of the property as if it were vacated at the end of a lease or abandoned. Change the locks, remove garbage and food, and do necessary maintenance and repairs to prepare it for the next tenants.

If something doesn’t happen according to the cash-for-keys plan you have agreed to, you must proceed with the eviction process outlined by your state.

Not every cash-for-keys scenario works out so cleanly. Many landlords find themselves in a pickle when they make easily avoidable mistakes.

Even if you try your best to ensure everything goes as smoothly as possible, things can always come up along the way. These are the top five common mistakes that get property owners into hot water when attempting to remove tenants from the property.

This is the most common mistake that frustrated and exhausted landlords make. While it is understandable that property owners get upset about being unable to regain control of their rental property, that doesn’t mean that self-help evictions are allowed.

What exactly is a self-help eviction?

A self-help eviction is when the landlord makes it so the tenant cannot access or safely live in the property.

Landlords cannot take matters into their own hands and make the tenants’ lives miserable by doing lock-outs, shutting off the utilities, refusing repairs, or using any other method to keep the tenants from accessing or inhabiting the property.

Not only is it illegal, but the landlord can also be on the hook for fines and have to pay the tenant for spoiled food, wasted utilities, and, in some states, a set dollar amount per day they’re locked out.

You cannot use this method even when the tenant won’t see reason and tries to talk to you about moving out or following the lease rules. Instead, you must file an eviction suit with the court system immediately to legally regain property control.

It is illegal to physically or verbally threaten tenants, yell at them, stalk them at work, or harass other family members. No matter how frustrated you may be, always remain professional.

A looming eviction can be emotionally charged for the landlord and the tenant. Try to remove the emotion as much as possible and clearly communicate the situation.

Sometimes, tenants will attempt to talk you up in the amount, and if you keep agreeing, they may feel like you will negotiate even more.

You can start low and work up to the amount you’re willing to pay so tenants feel they are getting a great deal.

Or you can start high, hoping the amount will impress them, and stand firm. Just don’t get desperate and start offering amounts you have yet to think through or are not financially worth it.

Negotiating some move-out terms is okay when you’re trying to do a quick cash-for-keys transfer. For example, you may agree to allow the tenant not to patch holes or repaint rooms when they are moving out on short notice. Alternatively, you can negotiate, but only up to an amount equal to your legal fees for eviction .

However, you want to avoid agreeing to things that will make the situation too expensive or time-consuming. Plan what types of concessions you are willing to make in advance, and stick to that line. Otherwise, you may end up in a more trying situation than a court-led eviction would have been.

Although it is called “cash for keys,” landlords should always pay via check if possible. That way, you have an official record of the transaction.

If you have negotiated to pay in cash, then make sure you both sign something that records proof of the transaction. Provide the tenant with a receipt and create a copy of it for your records as well.

Why is it so essential to keep transactional proof?

Even if a tenant seems very amenable to the situation, they may come back later and try to claim that they were illegally forced out. However, if you have documentation of them accepting payment and agreeing to the arrangement, it will be much harder for them to make any headway with this type of case.

Cash for keys is separate from the tenant’s security deposit. Just because they leave doesn’t mean they forfeit that deposit automatically.

You still have to process the deposit as you usually would: do a formal move-out inspection and deduct for back rent, damages, and unpaid utilities.

Most states require that you send tenants a written, itemized list of all deductions and any remaining amount. Forgetting this important step, even if the deposit is wholly withheld for the above reasons, could lead to legal action from the former tenant.

It is highly possible, and even likely, that tenants moving out through cash for keys will not get their deposit back because of damages . However, you cannot just assume that. Do a formal inspection and send out the necessary checks and documentation as quickly as possible to prevent potential issues.

A cash-for-keys agreement form (sometimes called a cash-for-keys letter) should always be in writing.

It needs to include how much tenants will receive and how that payment will be made. It should also contain the deadline for turning over keys. The agreement should state that the landlord and tenant will go through the property on moving day to assess damages.

Just click here to download RentPrep’s free cash-for-keys agreement form .

The link above includes the cash-for-keys addendum you will sign on move-out day. This addendum gives the final update to the lease so that it is clear the lease is no longer active and all parties agree about the move-out. It’s critical to get this signed.

Determining the average cash for keys amount can vary widely based on location, property condition, and tenant circumstances. Most landlords find that offering a sum equivalent to one or two months’ rent encourages a swift and amicable departure.

Remember that the average tenant eviction costs around $3,500 in lost rent, court fees, attorney fees, and additional damages.

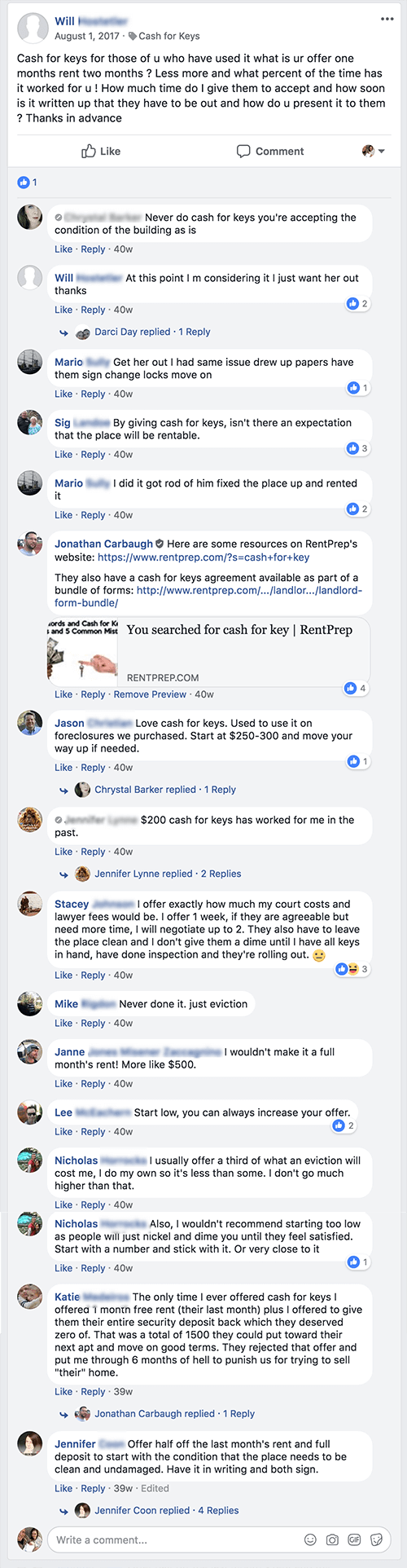

This question was posted in our private Facebook group, RentPrep for Landlords .

Here are a few opinions on cash for keys amounts:

We’ve had Lee McEachern on our podcast (we discussed the rental application process), and he teaches property management courses and manages 500+ rentals in the Bay Area.

I mention this because we tend to trust his judgment, and he advocated for starting low and increasing your offer.

If you join our Facebook group, you can see a section of the group called “Topics.”

In the image below, you can see that we’ve tagged 17 posts that you can read through where the topic of discussion is cash for keys.

You can join our group by entering your email in the form below.

You will be emailed the link to the group along with the password you’ll need to provide.

Cash for keys isn’t always between a landlord and a tenant. It can also be a situation between a homeowner and the bank that owns the mortgage. This scenario plays out the same way that a cash-for-keys situation between a landlord and tenant works.

The bank (landlord) wants to recover their property quickly and with as little damage as possible. This is why the bank will offer an agreed-upon amount of cash for the homeowner (tenant) to leave the property.

The most significant difference is that the stakes are much higher, and the bank has no interest in owning the property.

A bank may offer $2,000 to $3,000 in a cash-for-keys agreement because the costs will increase much quicker if they go through a lengthy eviction. Many banks will not offer this without the homeowner bringing it up first.

When landlords facing a challenging situation first hear about cash for keys, they often feel like it is too good to be true. Why would a tenant who has been causing them grief move out so easily?

Fortunately, the good news is that most tenants who can’t pay rent usually jump at the chance to have cash in hand and avoid a judgment on their records.

A favorite saying of mine is, “Sometimes the juice isn’t worth the squeeze.”

I have come across landlords who want to go through with the eviction process so they can get the judgment on the tenant’s record and feel vindicated for the anguish they’ve gone through.

The idea of paying someone who causes you grief is a hard pill to swallow.

I always recommend taking the emotion out of your decision-making and looking at it as a business decision. It may feel like you’re losing by offering cash for keys, but your bottom line may be a win.

Give our tenant screening guide a read to ensure you don’t have to repeat this process. It will show you the warning signs of bad tenants and how to find the perfect renter for your property.

Additionally, more consistent and accurate tenant screening can be a big benefit. By hiring a high-quality tenant screening service, you can ensure that you are always bringing in the best tenants possible. Great tenants are less likely to cause this grief and can improve your long-term business. Learn more about RentPrep’s tenant screening options to see what might improve your system today.

Here are a few of the most frequently asked questions when developing a cash-for-keys agreement.

Cash for keys is a situation where a landlord or lender offers a certain amount of money to a tenant or homeowner, respectively, for them to vacate the property. Landlords offer these funds to tenants who will be evicted or when they plan to sell the property , while banks typically do this when a home is going to be foreclosed on.

Offering a lump sum of cash instead of pursuing either eviction or foreclosure speeds up the process and saves money for everyone involved. It is often a better rental business decision for landlords, even though it can feel like you are giving money away.

There is no predetermined amount you will need to give tenants in a cash-for-keys situation, which is one of the most significant variables. The amount that you decide to offer will depend on several factors:

The answers to these questions will determine how much you should offer. Tenants who will be evicted regardless will not need as much to be encouraged to leave, while tenants who can wait out their lease otherwise may need more encouragement.

Ultimately, you’ll have to decide what is a good number for your rental business and see if your tenant agrees. Otherwise, you’ll have to try another option.

Some tenants may worry that accepting a cash-for-keys offer will hurt their credit. However, this could not be more incorrect, and they likely misunderstand what will happen during this process.

Accepting a cash-for-keys offer will not affect a tenant’s credit because they voluntarily move out in exchange for a lump sum. Nothing in the situation will ping their credit, nor will a creditor be involved.

Take some additional time to explain how cash for keys works if a tenant is concerned about their credit score. It might be prudent to highlight that an actual eviction case is more likely to affect their credit, if applicable. This might be the information they need to decide whether or not cash for keys is a good choice for their situation.

Some tenants may ask if the money they receive as payment for a cash-for-keys situation will be taxable. Unfortunately, the answer to that question is likely too complicated for you as a landlord to answer, as it is dependent on many different things. Some of the factors determining how the tenants will need to file this extra income are things that you will not know and are entirely dependent on their tax status.

In most situations, however, the payment will be considered extraordinary rather than rental income, and it should be filed under miscellaneous funds on their tax return. However, for more specific tax questions, the tenant should discuss them with a professional tax preparer, as they will have the most accurate answer.

Sometimes, when you offer a cash-for-keys plan to a tenant, they may offer their own suggestions on how to handle them moving out. This type of negotiation may be off-putting initially, and you might want to avoid agreeing to any of their terms.

Whether or not you allow any room for negotiation in a cash-for-keys situation is up to you. If the tenant in question is an excellent tenant whom you are asking to leave so that you can remodel or sell the property, leaving room for negotiation is probably in your best interest.

However, if you are dealing with a tenant who has caused many problems and is likely to be evicted, holding firm to the amount you have predetermined to offer might be better. Otherwise, they might simply be taking advantage of your good nature to benefit from what would otherwise be a very damaging eviction on their record.

No, the two are different. Banks and lenders often offer cash for keys to tenants living in a foreclosed property or homeowners who plan to accept a deed instead of a foreclosure option. In both instances, the bank is trying to get the property into vacant status as quickly as possible so they can resell it now that it is their property. Lenders want to avoid managing rental properties and want foreclosed homes vacated as soon as possible. Thus, they offer cash for keys in many scenarios.

If you feel trapped by a frustrating tenant but unwilling to try an eviction at this time, you might benefit from cash for keys. This method is typically less costly in time and money, leading to favorable outcomes.

This doesn’t mean it will be the right solution for every situation or every landlord, but there’s a good chance you might find a use for it in the future. Hopefully, today’s guide has set you up with everything you need to know to try it.

Our tenant screening services have been trusted by over 100,000 landlords & property managers since 2007. SEE OUR PACKAGES

Starting at just $21.00!